Federal Reserve and its decision on interest rates have profound implications on households as well as businesses. Central banks all over the world use interest rates as a tool to support an economy in a recessionary period by increasing the money supply and contracting the economy by reducing the money supply in an expansionary period. In its most recent meeting in Mar’2024, the Federal Open Market Committee (FOMC) kept its interest rates unchanged at 5.25%-5.50%. The Committee thinks that the policy rate has reached its peak for this tightening cycle, which began in early 2022. The FOMC is strongly committed to returning inflation to its 2 percent objective.

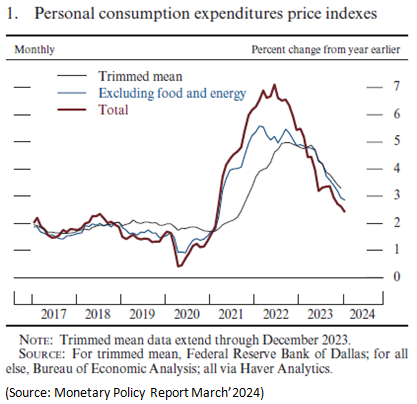

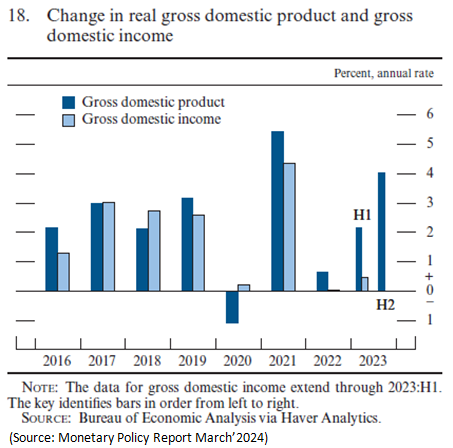

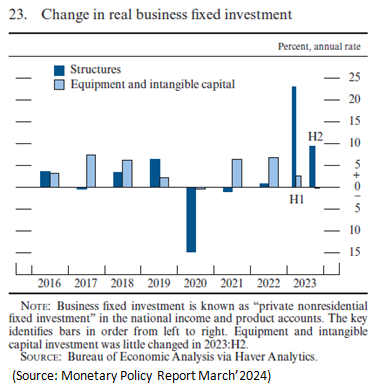

While inflation remains above the Federal Open Market Committee’s (FOMC) objective of 2 %, it has eased substantially over the past year. After surging in 2021 and 2022, inflation slowed notably last year. The price index for personal consumption expenditures (PCE) rose 2.4 percent over the 12 months ending in January, down from a peak of 7.1 percent in 2022, though still above the Federal Open Market Committee’s (FOMC) longer-run objective of 2 percent. The labor market remains relatively tight, with the unemployment rate near historically low levels and job vacancies still elevated. Real gross domestic product (GDP) growth has also been strong, supported by solid increases in consumer spending. Real gross domestic product (GDP) is reported to have increased at an annual rate of 4.0 percent in the second half of 2023, up from 2.2 percent in the first half. For 2023 as a whole, GDP increased by 3.1 percent, notably faster than in 2022 despite restrictive financial conditions, including elevated longer-term interest rates. Consumer spending grew at a solid pace, and housing market activity started to turn back up in the second half of 2023 after having declined since early 2021. Consumer spending adjusted for inflation grew at a solid rate of 3.0 percent in the second half of 2023 and 2.7 percent for last year as a whole. Consumers’ resilience in the face of tight financial conditions was supported by the strong labor market and rising real incomes. However, real business fixed investment growth slowed, likely reflecting tighter financial conditions and downbeat business sentiment.

Lending to households and businesses by banks slowed notably since June 2023 as banks continued to tighten standards and demand for loans softened. Tighter financial conditions are putting upward pressure on asset valuations, with real estate prices elevated relative to rents and high price-to-earnings ratios in equity markets. Consumer financing conditions have tightened over the last year. However, Credit remains available to most consumers, though interest rates on both credit cards and auto loans remained higher than the levels observed in 2018 at the peak of the previous monetary policy tightening cycle. The rise in mortgage interest rates since early 2022 has reduced the overall demand for housing and slowed activity in the housing sector appreciably. The change in mortgage rates was unusually large and rapid, with 30-year fixed rates rising from about 3.2 percent in January 2022 to almost 8 percent in October 2023, the highest level since 2000. Although mortgage rates have declined somewhat since October, they still averaged around 7 percent in February 2024. Moreover, a tighter financial condition and downbeat business sentiments have resulted in a slowdown in business investments in the second half of 2023. During the second half of 2023, the country experienced a decline in Equipment Spending while investment in software and R&D decelerated from its solid pace of growth over the previous few years. In nonresidential structures, investments in semiconductors or electric vehicle batteries also decelerated in the second half of 2023. Although indicators of business sentiment and profit expectations have improved in recent months, sentiment remains subdued.

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188) authorized representative of Alpha Securities Pty Ltd (AFSL No.330757). Ace Investors has made all efforts to warrant the reliability and accuracy of the views and recommendations articulated in the reports published on its websites. Ace Investors research is based on the information known to us or which was obtained from various sources which we believed to be reliable and accurate to the best of its knowledge. Ace Investors provides only general financial information through its website, reports and newsletters without considering financial needs or investment objectives of any individual user. We strongly advocate that you seek advice, with your financial planner, advisor or stock broker, the merit of each recommendation before acting on any recommendation for their own specific financial circumstances and realize that not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability, to the scope permitted by law to resupply of the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide.