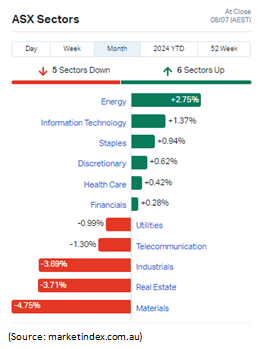

The leading Australian benchmark index S&P/ASX 200 (XJO) which is considered the investable benchmark of the Australian equity market declined 1.23% over the last month to 7,763.2 points on 8th July’2024, impacted by heavyweight miners BHP, RIO Tinto, FMG, South32 (S32), etc. The All Ordinaries (XAO) index (which contains the 500 largest ASX listed companies) is considered a total market barometer for the Australian stock market declined 1.24% to 8,012.2 points today. Sectorwise, sectors such as Energy, Information Technology, Staples, Discretionary, Health care, and Financials have performed well. Here, we are going to discuss about the consumer discretionary sector, its drivers, and the outlook of the sector.

Consumer discretionary sector and its drivers

The consumer discretionary sector is an economic classification of sectors and is considered cyclical i.e., they are susceptible to changes in consumer spending, rising and falling interest rates, wage growth, unemployment, and inflation all affect consumer spending. Consumers are less likely to spend on goods that are non-essential when economic conditions worsen. On the other hand, they are likely to open their purse strings when conditions improve (the cycle evolves). On the other hand, defensive sectors are relatively less affected by economic volatility. Most people will spend much the same on them regardless of economic pressures. They generally offer investors regular dividends and stable earnings regardless of the state of the economy. The consumer discretionary sector includes goods and services that are non-essential i.e., consumers can usually live without them and don't necessarily need them in their day-to-day lives. They can cut back on them or forego them altogether without any major consequences to their well-being. Some common types of consumer discretionary items include Fast food, Specialty food, Furniture and appliances, Vacation and leisure activities, Apparel, and Vehicles. Demand for these goods tends to increase when the economy is going to do well.

Consumer confidence plays a key role in the consumer discretionary sector and investors are watching this indicator closely to gauge the outlook of the sector. The Westpac-Melbourne Institute Consumer Sentiment Index recorded a modest 1.7% increase to 83.6 in June 2024 from 82.2 in May 2024 despite interest rate concerns, indicating an improvement in consumer sentiment outlook. The survey suggests that positive fiscal support measures are being counteracted by growing concerns about inflation and the outlook for interest rates. Several measures announced in the federal budget 2024-25 to abate cost of living pressure by the Australian government also played a key role in the improvement of Consumer Sentiment. To ease cost-of-living pressures for middle-class Australians, the Government has announced tax cuts for all Australian taxpayers in all income groups from 1 July 2024, increased rent assistance, and reduced electricity bills. The Government also provided $6.2 billion in new housing projects and an additional funding of $16.5 billion for infrastructure projects.

Outlook:

While initiatives such as easing the cost of living pressure will make available more money for households to spend and would likely affect sectors like retail, hospitality, and entertainment positively, initiatives like building more homes for Australians will create demand for building materials, and steel. In its latest monetary policy statement in May 2024, the Reserve Bank of Australia (RBA) has also outlined that GDP growth is forecast to increase gradually from late 2024, driven by a pick-up in household consumption growth. Consumption growth is expected to pick up to around pre-pandemic averages in 2025 following the earlier recovery in real incomes. This implies that the household saving ratio will lift over 2024 before declining later in the forecast period 2016-2026.

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188) authorized representative of Alpha Securities Pty Ltd (AFSL No.330757). Ace Investors has made all efforts to warrant the reliability and accuracy of the views and recommendations articulated in the reports published on its websites. Ace Investors research is based on the information known to us or which was obtained from various sources which we believed to be reliable and accurate to the best of its knowledge. Ace Investors provides only general financial information through its website, reports and newsletters without considering financial needs or investment objectives of any individual user. We strongly advocate that you seek advice, with your financial planner, advisor or stock broker, the merit of each recommendation before acting on any recommendation for their own specific financial circumstances and realize that not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability, to the scope permitted by law to resupply of the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide.

.jpg)