Since taking office, US President Donald J. Trump has announced an increasing number of tariffs on specific countries and commodities. On 1st Feb 2025, US President Donald J. Trump signed three executive orders to impose 25% tariffs on all goods imported from Mexico and Canada except for 10% tariffs on energy resources imported from Canada. However, a 25% tariff will be imposed on energy resources imported from Mexico. The orders were issued under the International Emergency Economic Powers Act (IEEPA) and became effective from 4 Feb’2025. President Donald J. Trump also imposed 10% tariffs on China, in addition to the existing tariffs of up to 25% on Chinese goods. In response to the initial order, then-Canadian Prime Minister Justin Trudeau retaliated with immediate 25% tariffs on C$ 30 billion worth of American goods and is preparing for a second round of tariffs on C$ 125 billion worth of American goods. On 4th Mar 2025, the Mexican president Claudia Sheinbaum enacted tariffs and non-tariff retaliation against the United States on 9th Mar 2025. On 6th Mar’2025, Trump delayed tariffs on goods compliant with the United States–Mexico–Canada Agreement (USMCA) until 2nd April 2025, which accounts for about 50% of imports from Mexico and 38% of imports from Canada. On 10th Feb’2025, the resident Trump announced 25% tariffs on steel and aluminum imported from all countries, including Canada and Mexico. On 10th Mar 2025, Canada imposed a 25% surcharge on electricity exported to the U.S. states of Michigan, Minnesota, and New York.

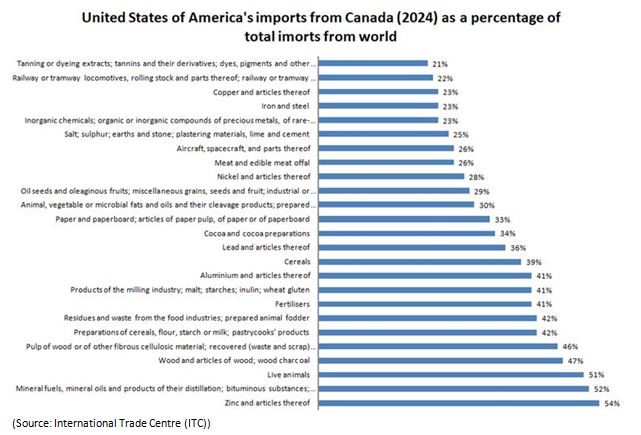

The bilateral trade relationship between the United States and Canada is one of the largest in the world, with exports from Canada to the US accounting for 16.8% of Canadian GDP and more than 2.6 million jobs in Canada in 2023. More than 70% of Canadian exports by value go to the US. Canada is the U.S.'s largest supplier of Minerals & Oils with more than 50% of Oils imported into the US being sourced from Canada. Canada is one of the largest suppliers of aluminum and steel to the US, with more than 40% of aluminum and more than 20% of steel imported from Canada to the US. The United States is Mexico's largest trading partner, with more than three-quarters of Mexico's exports going to the U.S. (79.6% in 2023). Mexico is the largest supplier of fresh fruits and vegetables to the United States, with more than 60% of vegetables sourced from Mexico. Mexico is also one of the largest suppliers of Automobiles and electrical machinery to the US with more than 30% of vehicles and parts imported into the US from Mexico and more than 15% of its electrical machinery imported into the US are from Mexico due to its proximity to the US and availability of cheap labor many companies have set up their manufacturing facilities in Mexico. (Source: Statistics Canada, World Trade Organization (WTO), International Trade Centre (ITC).

The trade war initiated by Donald Trump brought fears of rising inflation by increasing both manufacturing costs and consumer prices, and consequently, extreme volatility was observed in the U.S. stock market. The U.S. stock markets plunged after the imposition of tariffs on Canada and Mexico, and additional tariffs on China by President Trump on 3rd Mar 2025. The S&P 500 index declined by 1.8%, while the Nasdaq-100 index plunged by 2.6% on 4th Mar 2025. By 6th Mar 2025, the S&P 500 had lost almost all its gains since Nov’2024. On March 10, the S&P 500 dropped further by 1.4% following the interview of President Trump on Fox News, pushing the index into a correction defined as a fall in a stock market index of over 10% from its peak. The index lost over US$4 trillion in value from its peak on 19 Feb 2025.

The trade war is likely to disrupt trade between the United States, Mexico, and Canada significantly, and upset supply chains across North America. Many economists have expressed their skepticism over the effectiveness of Trump's strategy, and many have affirmed that increased tariffs would increase the prices of consumer goods in the U.S. and further deteriorate the cost of living. According to the Budget Lab at Yale University estimates, the tariffs would lead to a loss of about US$1,200 in purchasing power for the typical US household. While some companies will bear the cost of the tariff, others are likely to raise prices on consumer products to offset lost revenue. As the United States does not produce enough oil to meet its demand, the imposition of 10% tariffs on Canadian oil and energy will likely lead to an increased oil price across the United States. In response to the initial orders issued by President Trump, Canada imposed 25% tariffs on $30 billion worth of American goods including apparel and footwear, appliances, beer, coffee, and cosmetics. Canada is now preparing for a second round of tariffs on C$ 125 billion of American goods including Steel, aluminum, electronics electric vehicles, etc. A higher tariff on steel and aluminum imposed by Mexico and Canada could significantly decrease the earnings of US automakers as the US is one of the largest importers of aluminum and steel from Canada. The tariffs could also lead to price increases in various U.S. imports from Mexico, including fruits, vegetables, beer, liquor, and electronics from Mexico and potatoes, grains, lumber, and steel from Canada. These Price increases are likely to compound with already higher inflation in the U.S., especially in grocery prices.

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188) authorized representative of MF & Co. Asset Management Pty Ltd (AFSL No.520442). Ace Investors has made all efforts to warrant the reliability and accuracy of the views and recommendations articulated in the reports published on its websites. Ace Investors research is based on the information known to us or which was obtained from various sources which we believed to be reliable and accurate to the best of its knowledge. Ace Investors provides only general financial information through its website, reports and newsletters without considering financial needs or investment objectives of any individual user. We strongly advocate that you seek advice, with your financial planner, advisor or stock broker, the merit of each recommendation before acting on any recommendation for their own specific financial circumstances and realize that not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability, to the scope permitted by law to resupply of the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide.