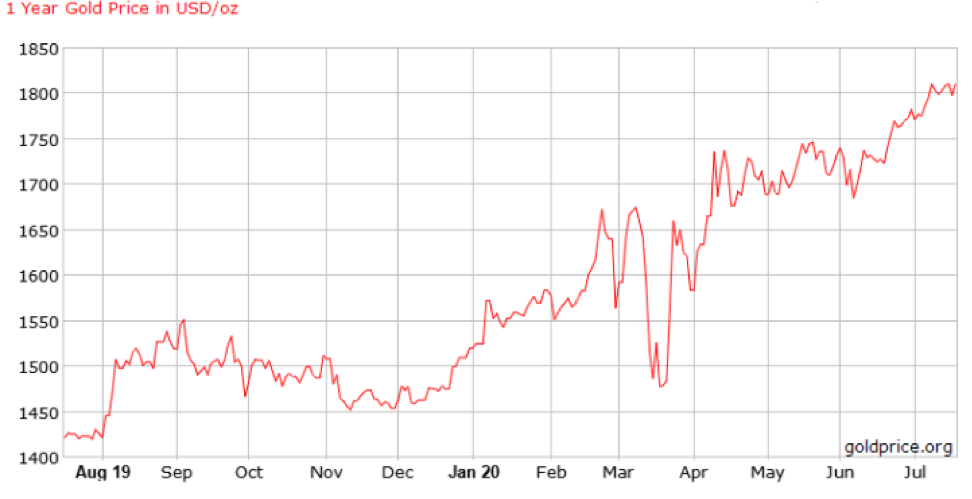

Gold as Safe Haven Assets - With the Coronavirus spreading rapidly across the world, the gold prices have benefitted from this pandemic and hits its 7 year high of $1,814.40. Gold always get benefits from global uncertainty. The Trump trade war with China has increased the investors’ attention last year and this year, the Coronavirus pandemic is taking the gold prices to new highs.

One Year Gold Performance

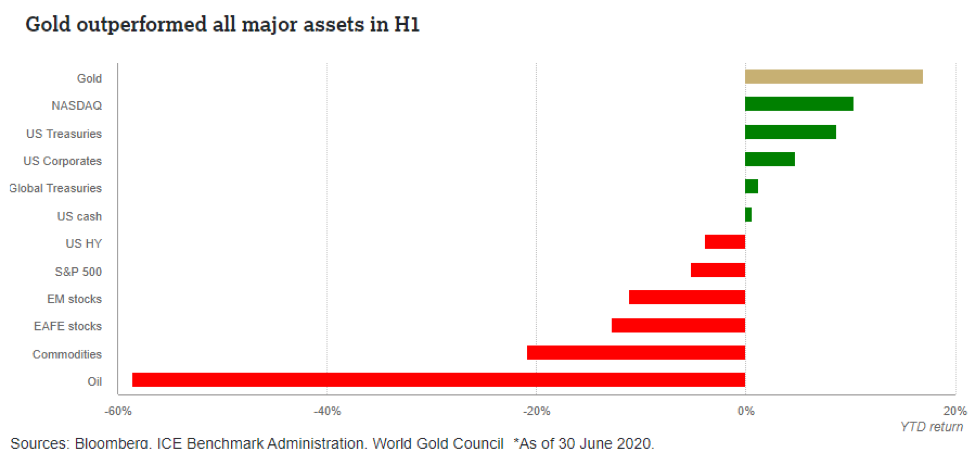

Investors have embraced gold in 2020 as a key portfolio hedging strategy. During H1 FY2020, the gold had a remarkable performance, increasing by 16.8% in US-dollar terms and significantly outperforming all other major asset classes.

Broad Factors influencing Gold Prices:

- Currencies – appreciation or depreciation of the U.S. dollar

- Economic growth and market uncertainty – inflation, interest rates, income growth, consumer confidence

- Tactical flows – price momentum, derivatives positioning

- Gold demand and supply dynamics – mine production, demand-side shocks.

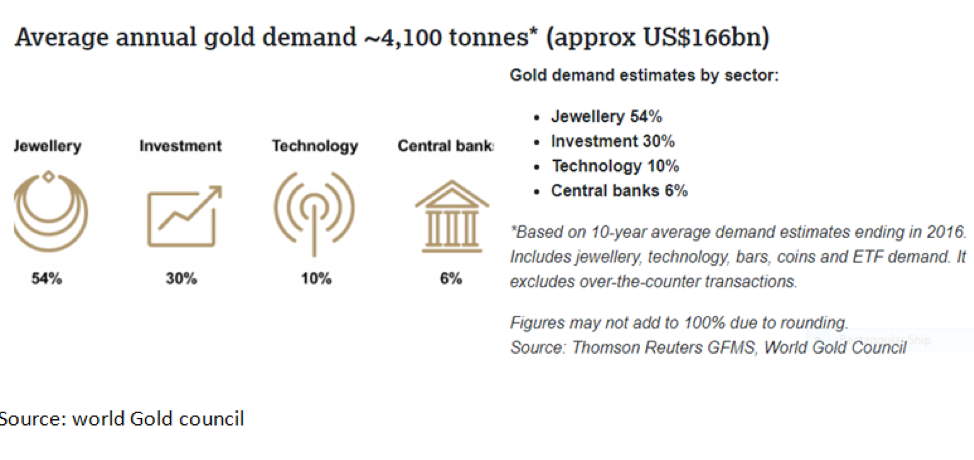

Where this Yellow Shining Metal is Used?

As per World Gold Council estimates the average annual gold demand is ~4100 tonnes per annum which is approximately equivalent to US$166bn. Jewelry, Investment, Technology, and Central Banks are the primary sectors that specifically influence the demand for gold. This diversity of demand and the self-balancing nature of the gold market underpin gold's robust qualities as an investment asset.

Investing in Gold

People across the globe consider gold as a store of value that can be used in times of economic distress. People believe that if all hell were to break loose, i.e. in case of a war or in case the economy or world comes to an end, the only thing that will have any value left will be gold and so it is important to stay invested in gold at all times.

The continuous increase in the gold prices indicates that investors are adding gold to their portfolios to protect against and hedge vulnerability during these times. Investment in gold provides safe portfolio diversification and helps in mitigating losses in times of market stress.

Different Ways to Invest in Gold?

Majority of people invest in physical gold either by buying jewelry, coins or bars. But there are different other ways by which investors can benefit from the rising price of gold.

[1] Buying Shares of The Companies Mining Gold – Australia holds a strategic position in the supply side by being the second-largest gold producer after China. Further, the gold production trend in Australia depicts a positive trend. Look below the performance of some gold producing companies, all have given strong return. The interest in gold stocks was fueled by global economic uncertainty.

|

Gold Producing Stocks |

Price as on 1st April 2020 |

Price as on 17th July 2020 |

Change % |

|

Alkane Resources |

0.63 |

1.24 |

96.83% |

|

Silver Lake Resources |

1.36 |

2.32 |

70.59% |

|

Saracen Mineral Holdings |

3.76 |

5.89 |

56.65% |

|

Evolution Mining |

3.9 |

6.08 |

55.90% |

|

Northern Star Resources |

10.31 |

14.94 |

44.91% |

|

NewCrest Mining |

23.4 |

32.78 |

40.09% |

|

Kirkland Lake Gold |

49.1 |

63.42 |

29.16% |

[2] Exchange-traded Funds (ETFs) are often considered as the next best thing to owning physical gold. ETFs are an investment vehicle traded in shares on an exchange, which tracks the underlying pricing index of that commodity. As per data from gold.org, gold backed ETFs recorded their seventh consecutive month of positive flows, adding 104 tonnes in June 2020 – equivalent to $ 5.6 billion.

Best gold ETFs listed on the ASX:

- ETFS Physical Gold (GOLD) – $1.8 billion in funds under management (FUM)

- Perth Mint Gold (PMGOLD) – $530 million in FUM

- BetaShares Gold Bullion ETF – Currency Hedged (QAU) – $254 million in FUM

|

|

1 YEAR RETURN |

3 YEAR RETURN (P.A.) |

5 YEAR RETURN (P.A.) |

|

GOLD |

27.4% |

16.1% |

10.6% |

|

PMGOLD |

27.1% |

16.9% |

11.1% |

|

QAU |

21.6% |

10.3% |

7.2% |

Source: Stockspot, ASX. Data as of 30 June 2020

Future Outlook: Is it the right time to buy or invest in gold?

There are many supportive factors for the current bull run and the market expects that this momentum will continue during H2 FY 2020 as well. Some of the factors supporting the continuity of gold price run includes:

- Major central banks across the world have reduced their interest rate to almost 0%, with an expectation of going in the negative territory. Rate cuts + Liquidity infusion by central bank is likely to have a spillover effect on the economy and going to support the metal prices.

- The demand for gold in 2020 has been supported by investment demand. Fear driven investment demand in developed countries has contributed to this year’s gain in gold prices. We expect that this trend is likely to continue in the H2 FY2020.

- High liquidity in the system, will spike the inflation rate in the economy. Lack of returns in many other asset classes will drive money towards gold.

Market experts believes that for CY 2020, the gold price is likely to hold support at $1610-1580 zone and the current rally could extend higher towards its all-time high level of $1920. There are also assumptions that the price is expected to extend its bullishness by another 30% to $2500 during FY 2021.

We believe that there is no right or wrong time to purchase or invest in gold. With the prevailing global uncertainty, Investors can consider investing in gold to provide diversification to their portfolio. Rather than holding physical gold, stock market investors can buy shares in companies that have gold exposure, such as gold miners, or they can buy units in a gold-themed exchange traded fund (ETF).

Disclaimer: Ace Investors Pty Ltd (ABN 70 637 702 188) authorized representative of Alpha Securities Pty Ltd (AFSL No.303575). Ace Investors has made all efforts to warrant the reliability and accuracy of the views and recommendations articulated in the reports published on its websites. Ace Investors research is based on the information known to us or which was obtained from various sources which we believed to be reliable and accurate to the best of its knowledge. Ace Investors provides only general financial information through its website, reports and newsletters without considering financial needs or investment objectives of any individual user. We strongly advocate that you seek advice, with your financial planner, advisor or stock broker, the merit of each recommendation before acting on any recommendation for their own specific financial circumstances and realize that not all investments will be suitable for all subscribers. To the scope permitted by law, Ace Investors Pty Ltd excludes all liability for any loss or damage arising from the use of this website and any information published (including any indirect or consequential loss, any data loss or data corruption). If the law prohibits this exclusion, Ace Investors Pty Ltd hereby limits its liability, to the scope permitted by law to resupply of the services. The securities and financial products we study and share information on, in our reports, may have a product disclosure statement or other offer document associated with them. You should obtain a copy of these before making any decision about acquiring any security or product. You can refer to our Financial Services Guide.